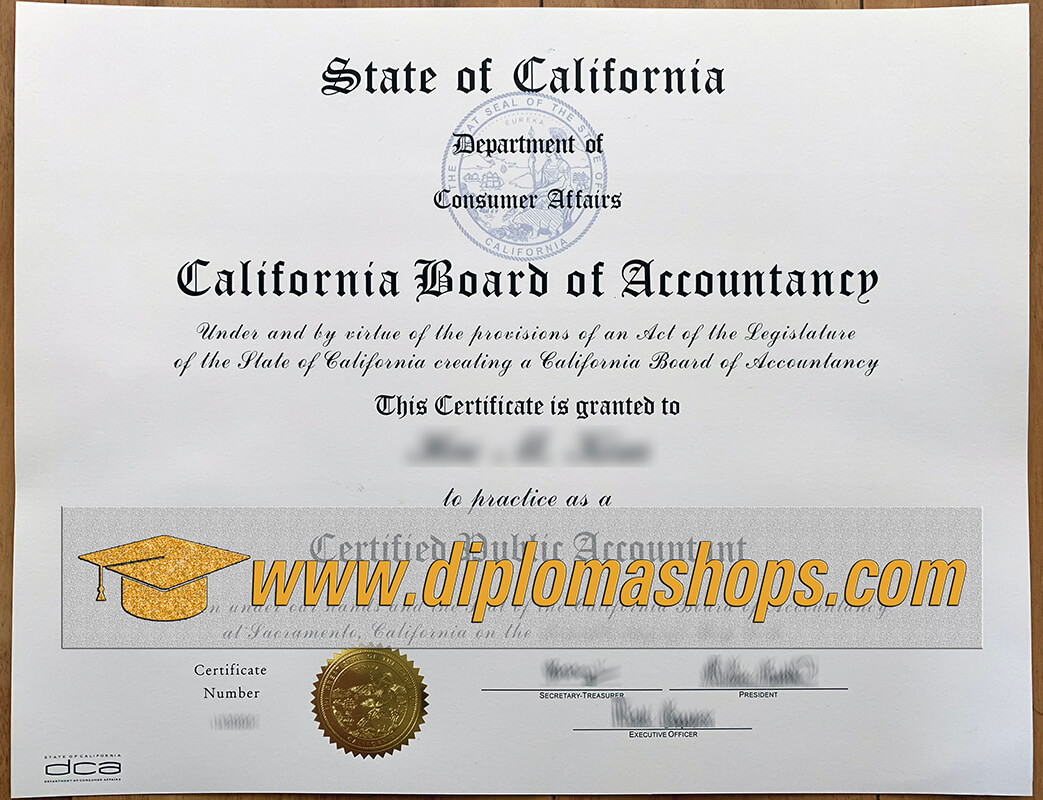

How to purchase a fake certified public accountant s at California certificate? get a fake CPA certificate, make a fake CPA certificate, how fast can I get a California CPA certificate? buy fake diploma, buy fake degree, buy fake transcript, buy fake certificate, The academic requirements for the California CPA exam are not critical, but the additional requirements for accountancy qualifications are a bit more complicated. buy fake California Board of Accountancy Certificate, make a fake California Board of Accountancy Certificate, More importantly, the California Accounting Authority did not require candidates to present a Social Security Number (or SSN) when taking the test; however, you must have an SSN to apply for a California Certified License (CPA license).

buy fake degrees, buy fake diplomas, buy fake transcripts, buy fake certificates, The Association (AICPA) was established in 1887. According to the AFPA Association’s latest 2013 fiscal year report, the number of AICPA members has exceeded 360,000 in 2013, reaching 36,2016. fake PMP Certificates, In 2005, the number of AICPA members have reached 327,135 people, the number of members has increased by nearly 40,000 in 8 years.

In the course of more than a century, buy fake AICPA certificate, buy fake CPA certificate, AICPA has become the most influential accounting professional organization in the world.

If you pass the CPA exam and do not apply for a certificate/practicing qualification, buy a fake CPA certificate in California, buy a CPA fake certificate in Texas, buy a Texas CPA certificate, buy Illinois fake CPA certificate. you cannot print the three English words of CPA on a business card. So if you don’t have an SSN (or don’t know what SSN is), California should not be for you.

1. Academic qualifications for taking exams in California

Four years of bachelor degree or above

Accounting Course: 24 credits

Business course: 24 credits. For details, buy the California Certified Public Accountant certificate, please click to view the California CPA Exam Booklet 2. AICPA Certificate, Additional requirements for obtaining a CPA license

Must complete 150 credits;

Accumulate one year of work experience in the accounting department of an accounting firm or other institution.

Please note:

If you are working in public accounting, do you like the Australian CPA certificate? your supervisor can be a non-US CPA; if you are working in a non-public accounting department, your supervisor must be a CPA.

other requirements

Check out the California CPA Education Foundation page for more information on the California course in Professional Ethics for CPAs (PETH).